Electric Vehicles Today:

Porsche’s new hybrid car, the Löhner-Porsche, has more horsepower than its P1 electric vehicle. In the next few years, Ford will begin plans to bring its own mass-market EV to market. Electric charging stables and battery swapping locations support longer road trips. The market share of EVs is 28% in the US. The year is 1900, over a century before today’s electric mobility craze.

Futurists, like Thomas Edison, believed electric vehicles would be used for most transportation. They were over a century of technology off, and even today improvements are needed for mass market EVs. Understanding the market dynamics of each Industrial Revolution sheds light on the evolving battle between electric and combustion engine vehicles.

Why did electric vehicle adoption fail in the Second Industrial Revolution (1900’s steel, electric, and petroleum)?

1. Revenue model and cost structure

a. Too few customers: Cars before 1900 sold to private individuals were an elaborate upgrade to horse-drawn carriages, not a utility. Few could afford a basic electric car costing over $1000, while the gas Model-T was priced around $500 (Idaho National Laboratory). Because fewer electric vehicles were sold, the economies of scale would not lower their production price or maintenance costs.

b. Expensive electricity and storage: Electricity must be used or stored once produced, and both lacked at the beginning of the 20th century. The electricity was not accessible to the average consumer until after the 1920s when Samuel Insull convinced the government to allow a natural monopoly of large scale power stations and power grids (American History). Expensive batteries of the time held little charge and had a short lifecycle. Henry Ford scrapped the $1.5M investment into mass-market electric vehicle plans due to the batteries’ inability to power a car (Wired). With fewer places to charge batteries and the range of being inferior, consumer demand turned to gas vehicles.

2. Dynamics from the most recent Industrial Revolution and their ownership of complementary market offerings shifted investment to gas vehicles.

a. Oil Business: The first industrial revolution brought light into homes and factories at night via kerosene lamps. Standard Oil, initially discarded gas in the refining process as it had no commercial use (US Energy Admin). Oil companies soon realized gas sales could be higher than kerosene as consumers refilled their cars, and the distribution of gas could be trucked to remote regions.

b. Gas Stations: When Gulf oil created the first drive-in gas station in 1913, it allowed consumers to have an attendant fill them up instead of bringing a canister into a pharmacy or blacksmith for gas (American Oil &Gas). The added benefit of stations was a storefront focused on automotive service and travel. Consumers could get oil changes, spare parts, and guides to the road ahead at each gas station.

Why will electronic vehicle adoption succeed in the Fourth Industrial Revolution (cyber-physical)?

1. Revenue models and costs will eventually make transportation cheaper with EVs.

a. Ride-Sharing and Fleets: Mobility business models offer many price access points to consumers and remove the requirement to own a sizeable depreciating asset. Government subsidies are speeding up adoption, especially in regions like China, Europe, and California. Ridesharing and auto-sharing services shift consumer mindset into on-demand transportation much like the 3PL & 4PL trucking models already widely used in the commercial freight industry. Eventually, autonomous electric vehicles will reduce the need for a human driver and improve safety.

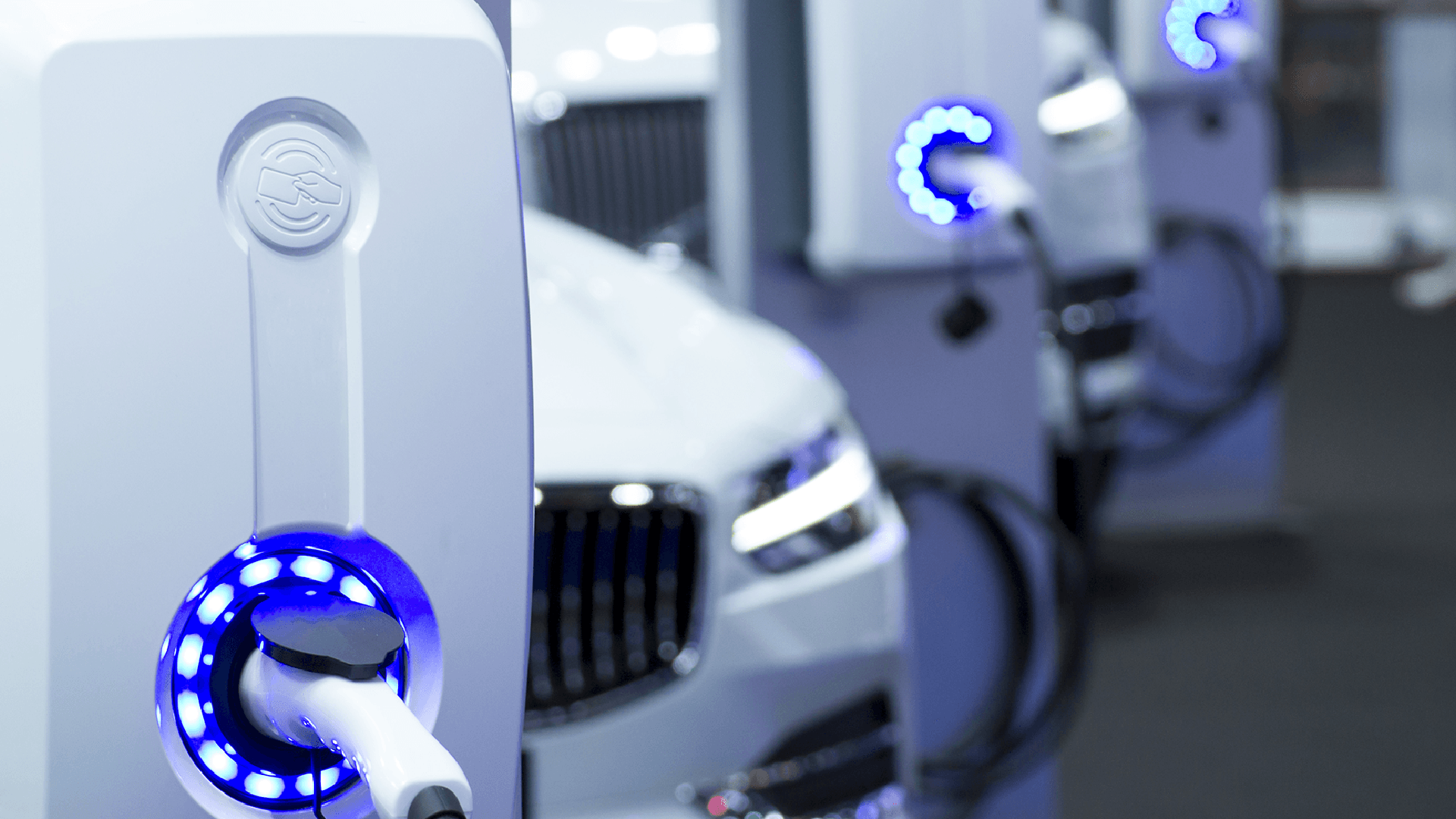

b. Battery Revolution and Chargeability: The price of battery storage has been reduced by half in the past decade but remains the highest component cost in EVs. Increases in production volume and advancements to the underlying performance lifecycle will continue to lower costs from the massive investments. Traditional retail gas stations numbers have been dropping while numbers of electric charging stations are increasing at public places, business parking lots, and in private residences. The US has over 20,000 charging stations, with 16% being fast chargers (Department of Energy). There is still a gap in storage and charging, but this is shrinking with the support of government incentives and massive investments by traditional automotive players.

2. Dynamics from the past Industrial Revolutions players, and complimentary markets

a. Tech industry: The Third Industrial Revolution brought about the internet, portable use of electronic devices, and information networks. Massive tech companies like Google, Baidu, and Alibaba are pouring money into mobility race and autonomous vehicles. Amazon recently made the largest order of EVs. The massive tech companies greatly benefit from increasingly electrified connected cars. EVs will increase demand for ecosystems of hardware components, software, and data. Mobility as a Service (MaaS) will overlap manufacturers, utilities, telecommunications, and software companies.

b. Connected car: By integrating LTE and 5G into cars, technology companies will be more involved with Mobility as a Service (MaaS). Voice assistants widely used for entertainment, navigation, and ordering can be integrated into the hardware systems like air conditioning, safety, diagnostics, and assisted driving. Connected vehicles will be joined to broader IoT ecosystems like smart homes, smart cities, smart factories, eCommerce, and cloud data.

While the competition between electric and gas drivetrains continues, it has broad implications on how products and services are delivered to consumers. Manufacturing demand for raw materials will shift, along with the entire infrastructure of power and data. Autonomous cars are a great example of how the cyber and physical worlds blend in the Fourth Industrial Revolution.

As one of the world’s largest professional services firms, Baker Tilly is improving client’s businesses through value enhancement and protection. We help clients with change through every phase, from assessment and design to implementation and support. Past projects related to Industry 4.0 have included trade & tariffs, growth strategies, tax credits, shop floor machine integration, cyber-security, robotic process automation, analytics and ERP, CRM, and MES software. For more information, Click here or reach out to Ryan Holzhueter at ryan.holzhueter@bakertilly.com.

The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. © 2019 Baker Tilly Virchow Krause, LLP

Edward Mulford is a consultant for Baker Tilly’s Enterprise Transformation Services team. He has assisted clients in implementing cloud-based ERP systems, redesigning organizational processes, improving accounting reporting, and increasing security. With a BBA in Integrated Supply Management from Western Michigan University, Edward is passionate about how things are designed, sourced, manufactured, and delivered. He connects people with technology in order to solve complex problems.