Implementing new technologies within the delicate dance of business and market trends can be a daunting task. As a business owner, I feel your pain — our team has our share of successes and failures. As a team member of Automation Alley, we have sometimes undergone painful tech changes that required a shift in skills and culture. In our Industry 4.0 Readiness Assessment program, companies juggle the grind of fulfilling orders, labor shortages, and economic uncertainty. Consequently, it is not surprising that Industry 4.0 can be at the back of some owners’ minds. The margin of error can feel slim, which makes prioritizing actions that may not impact the bottom line in three years, sometimes three months, seem like wishful thinking.

So how do you add tomorrow’s tech without threatening today’s cash cow? It takes an understanding of how your company’s pain points need the right investment framework to turn those roadblocks into opportunities. It also takes understanding how technology can amplify success. That knowledge must exist at all levels, so team members can adapt to change more quickly than their peers. If companies prioritize learning over hubris, they form a more robust foundation that can grow with resiliency.

Overwhelming? It can be if you take on Industry 4.0 all at once and by yourself. Small bets at the right time can turn something small into your next great product or service. Let’s dive into how to have an offensive and defensive mindset regarding your financial and technology decisions.

The Investment Framework

Everyone on the team, from owner to laborer, invests time and energy into the business. Along with financial capital and tools, these investments drive the business. We view these financial and technology investments in two distinct categories: Defensive and Offensive investment strategies.

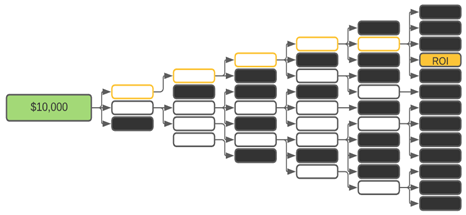

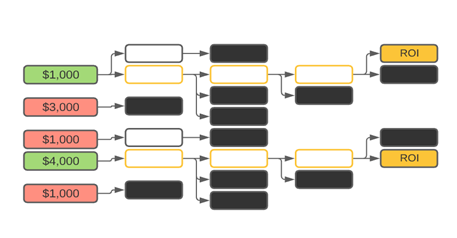

A Defensive strategy is best used in parts of the business with relatively low degrees of failure allowed to happen. Equipment or software critical to the team’s success cannot face significant disruptions. So, if a big change is needed, it is usually in technology with a well-known ROI (Return on Investment) that can be quantified using valuation models like payback period or net present value. The company invests capital initially, and most employees spend time and energy after the initial purchase. This framework is typical for most organizations.

Automation Alley Example: We recently changed software packages to manage member data and deliverables. One of our long-term goals was to make better decisions using data. The current system couldn’t support our data integration and analysis needs to achieve our goals. This was a Defensive investment since the technology was well-known, a significant upfront cost, and involved critical parts of our organization.

What if you do not know the technology well yet want to try it out? An Offensive strategy is best used on flexible parts of the businesses. It may be a piece of underutilized software or equipment. Since the ROI is unknown, we limit the initial exposure of capital, time, and energy in the beginning. We take small bets with each decision, hoping we have found something transformative at the journey’s end. A binomial option pricing model can be used to quantify this strategy. The company’s capital, time, and energy are spent throughout the project because the initial probability of implementation is relatively low.

Automation Alley Example: Prior to and accelerated by the COVID-19 lockdown, we decided to provide more flexible conference options for our members and ourselves. We tested video conference packages in one room. Once we found a solution we liked, we then expanded that capability to other conference rooms. This was an Offensive investment since we needed time to understand the tech, the ROI was unclear, and we had the ability to experiment with underutilized conference rooms.

Innovation at All Levels

Once you have figured out how to allocate your money, it is time to focus on your team. Digital transformation cannot be a top-heavy initiative, and we can use a blue-chip company like 3M as an example. Since 1948, 3M has allowed employees to spend 15% of their time on any innovation they desire. Products like the Post-it Note and many others were born from this simple rule, enabling them to create immense value for themselves and their customers. Other companies have followed suit, including Google’s 20% time. It is important not to overcomplicate innovation with rigid structure and time-tracking. It is meant as a valuable, creative outlet that employees can tap into while on the job.

Using 15% as the baseline, how does your team stack up? You may be too defensive if team members feel like they are spending 99% of their time on the day-to-day work. You may hear phrases like “We’re at capacity” or “We’re spread too thin.” You may see symptoms like stagnant sales growth or rising direct costs on the financials. Conversely, if 50% of their time is spent on white space, the organization may lack focus. You may see symptoms like rising one-time costs and underutilized assets on the income statement and balance sheet.

How can we help you on your journey?

Culture

Your business has many moving parts, and a strong culture can help manage that complexity. Our Industry 4.0 Readiness Assessment helps companies identify what is holding back their growth using technology. It is at no cost to all Michigan Manufacturers on a first come, first served basis. It is not an easy process — So if you are not ready, take the quick and easy Leadership Evaluation to understand more of how these concepts relate to your business.

Finance

If you have identified the small bets in your organization and you are a manufacturer in Michigan, apply for the MEDC Implementation Grant in your region. According to data collected from partners across the state, only 1.5% of Michigan manufacturers applied for this grant. Whether you need $25,000 for your Industry 4.0 transformation or aren’t ready yet, share this opportunity with your peers. We need as much effort and collaboration from all stakeholders to drive innovation and resiliency in Michigan’s economy.

Technology

Once your culture is set and you have the capital, you may need guidance on where to find the next tech. As part of MEDC’s Industry 4.0 Initiative, Automation Alley offers Essential Memberships at no cost to all Michigan manufacturers. We have collected the breadth and depth of Industry 4.0 knowledge from peers all over the state, nation, and globe. You will also have in-person and virtual access to events like Integr8, a conference where companies can learn how Industry 4.0 impacts all business areas. Make a small bet on innovation and you may find an Industry 4.0 technology to be your greatest Offensive investment.

Sign up today for a free Essential Membership to Automation Alley to keep your finger on the pulse of digital transformation in Michigan and beyond.

Eric Davis is the Chief Operating Officer of Project DIAMOnD at Automation Alley, where he oversees day-to-day operations, financial stewardship, and resource allocation to keep the program running smoothly. He has extensive experience conducting due diligence on public and privately held companies, is a registered investment advisor, and held a financial role for other non-profits. He previously coached varsity football at Southgate Anderson High School. Eric earned both his MBA and BBA (Finance) from Eastern Michigan University and is a Level III candidate in the CFA Program.